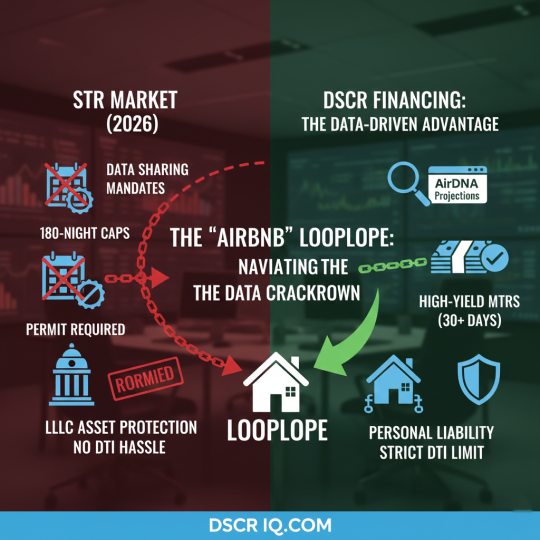

The year 2025 marks the end of the “wild west” era for short-term rentals (STRs). Automated data sharing between platforms and municipalities has extinguished the possibility of operating below the radar. Regulation is now a compliance cost, not a risk. For investors, the ability to secure financing relies on a single strategy: proving the property remains profitable after accounting for all regulatory restrictions.

The Data Sharing Era: Platforms as Enforcement Tools

City councils and state legislatures have leveraged the simplest enforcement mechanism available: forcing the booking platforms themselves to become regulatory gatekeepers.

- Mandatory Verification: Most major municipalities now require platforms like Airbnb and Vrbo to verify and display a valid local STR license or permit number on every single listing. Listings without a valid ID are automatically deactivated.

- Automated Reporting: The “Data Crackdown” means platforms are routinely sharing booking data (e.g., occupancy days, Average Daily Rate, host identity) with city compliance departments. This eliminates the chance to operate illegally.

- Lender Due Diligence: The first thing a DSCR lender verifies now is compliance status. If your property is in a jurisdiction with strict licensing, you must have a valid permit (or proof of application) to close the loan. The lender views the permit as essential collateral, as its loss renders the asset worthless as an STR.

AirDNA vs. Reality: The New Income Cap

In the boom years, lenders often took a property’s projected rental income directly from third-party analytical tools like AirDNA, which typically generated aggressive “optimal” occupancy rates (e.g., 90%). That era is over.

In 2025, DSCR lenders have baked in a significant risk buffer due to market saturation, economic uncertainty, and regulatory risk.

- Conservative Cap: Expect lenders to cap your projected income at 75% to 80% of the raw annual revenue projection provided by market data reports. This means if AirDNA projects $80,000 in annual revenue, the underwriter will only use $60,000 to $64,000 for your DSCR calculation.

- The DSCR Implication: This income haircut directly lowers your Debt Service Coverage Ratio (DSCR). If the property requires a DSCR of 1.10 for the best rates, that 20-25% reduction in usable income means your final ratio will be significantly lower, potentially pushing you into a higher interest rate tier or even loan denial. This is the most critical factor determining loan terms for STRs today.

Navigating the “Nightcap” Rule

Many high-demand markets (e.g., New York, Boston, Seattle) have imposed “Nightcap” ordinances, restricting non-primary residence rentals to a maximum of 180 nights per year.

This restriction drastically alters how lenders calculate property income:

| Scenario | Calculation Basis | Projected Annual Nights |

|---|---|---|

| Old Standard (No Cap) | 365 Days – 15% Vacancy | ~310 nights |

| New Standard (180-Night Cap) | Absolute Maximum Cap | 180 nights |

The DSCR Hit: A 180-night cap means the property’s maximum gross income is immediately reduced by nearly 40% compared to a no-cap environment. To qualify for a loan in these markets, you must target properties with exceptionally high Average Daily Rates (ADR) or very low acquisition costs. The DSCR calculation must factor in the mandatory nightcap, making qualification significantly harder.

The Loophole: The Mid-Term Rental (MTR) model (30+ days) is the strategic bypass. If your city defines STRs as stays under 30 days, pivoting to MTRs (travel nurses, corporate housing) allows you to use a full 365-day income projection while avoiding the nightcap and licensing burdens of the STR regulations.

Loan-to-Value (LTV) Limits: Market Differentiation

Lenders acknowledge that not all STRs carry the same risk. Regulatory stability and market maturity dictate the maximum leverage you can achieve:

| Market Type | Regulatory Risk | 2026 Maximum LTV |

|---|---|---|

| Metro Markets (e.g., Austin, Dallas) | Moderate, established rules | 75% LTV |

| True Vacation Markets (e.g., Gulf Shores, Poconos) | Lower, tourism-friendly | 65% to 70% LTV |

Why the Difference? Pure vacation markets are viewed as having less risk of sudden, severe regulatory changes since local economies are dependent on tourism. Metropolitan markets, driven by housing shortages, are prone to regulatory instability.

For you, the host, this means purchasing a property in a true vacation market requires a minimum 30% to 35% down payment, increasing your required capital reserves but lowering the political and regulatory risk of your investment.