DSCR – Investor Loans

Where Strategy Drives Approval.

Smarter DSCR Loans for real estate investors – qualify based on

property cash flow, not personal income.

Cashflow-Based Lending Explained

DSCR loans are designed for investors who want to qualify based on rental income—not W-2s or tax returns. We simplify the process and help you scale smarter.

Built for Investors. Trusted by Brokers.

No personal income ocumentation required

Title in LLCs or corporations

Fast approvals and flexible term

Dedicated broker support and education

Your Path to Smarter Financing

- Step 1: Prequalify & Submit Documents (48 Hrs) – Start your secure, NMLS-compliant digital application. We focus solely on your property, not your W-2s.

- Step 2: Expert DSCR Analysis & Appraisal Order (3-5 Days) – Our specialized team verifies the property’s market rent and confirms your target DSCR ratio.

- Step 3: Receive Term Sheet & Lock Rate (1-2 Days) – Review your tailored non-recourse or limited-recourse term sheet and lock in the best rate for your investment goals.

- Step 4: Swift Final Underwriting & Close (Avg. 10-14 Days) – Benefit from our in-house, investor-focused underwriting for a truly fast, transparent closing—often completed in under two weeks.

Empower Your Investment Strategy

- The DSCRIQ Advantage Guide

- Explainer Video

- Quick Course: “DSCR in 5 Days“

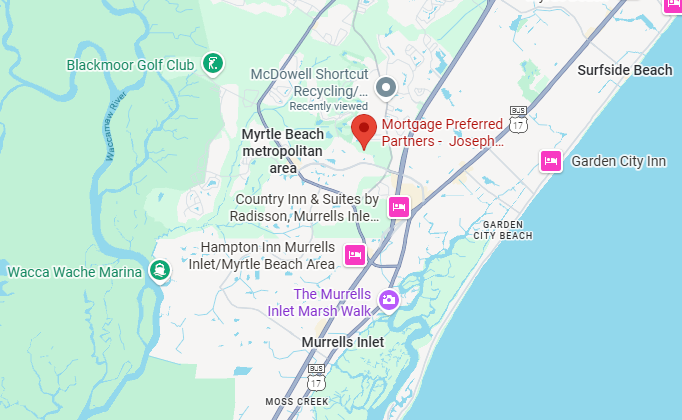

GET IN TOUCH

We Are Connected All Time To Help Your Business!

Telephone No:

(866) 484-8659 x701

C: (843) 212-7190

Email Address:

js@mpploans.com

Have a DSCR Loan Expert Contact You