The transition from a landlord to a real estate portfolio magnate is defined not by the number of doors you own, but by the legal and financial architecture underpinning them. For the sophisticated investor utilizing Debt Service Coverage Ratio (DSCR) financing, the ability to rapidly scale without the constraint of personal income documentation must be paired with an equally robust strategy for risk mitigation and capital preservation.

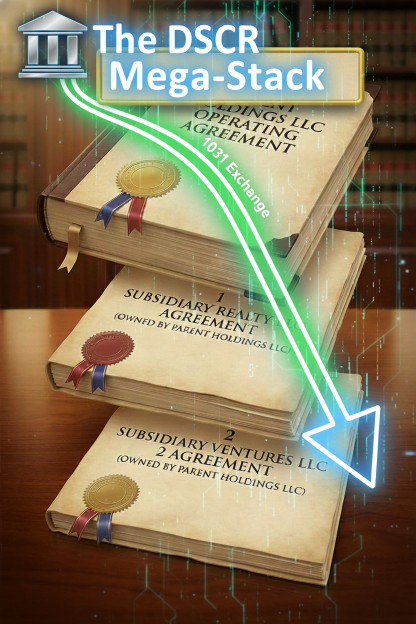

The DSCR Mega-Stack is the term we use for this advanced framework. It is the strategic convergence of entity layering, DSCR loan-to-entity flexibility, the compounding power of the 1031 Exchange, and the ultimate tax-advantaged passive exit: the Delaware Statutory Trust (DST). This is the blueprint for a truly institutional-grade real estate portfolio.

STAGE 1: Architecting the Foundation with Multi-Entity Layering

A DSCR loan’s flexibility—lending directly to a business entity—is the key feature that enables massive scale beyond the conventional four-loan limit. However, simply using a single-member LLC for every property exposes the entire portfolio to a single legal event. The Mega-Stack begins by implementing a sophisticated, layered ownership structure that separates liability.

The Holding Company

(Parent LLC) vs. Series LLC

The core of effective entity structuring is creating a firewall between assets. This is accomplished either through a Parent-Subsidiary LLC model or a Series LLC.

- The Parent-Subsidiary LLC Model (The “Traditional Stack”): This involves a single Holding Company (Parent LLC), often established in a business-friendly state like Delaware or Wyoming, that owns the membership interests of multiple Property LLCs (Subsidiary LLCs). Each subsidiary LLC holds one to three rental properties. The DSCR loan is originated to the Subsidiary LLC, which is then personally guaranteed by the Parent LLC’s owner. Crucially, a liability event in Property LLC A generally cannot pierce the Parent LLC and seize the assets held in Property LLC B or C.

- The Series LLC Model (The “Cost-Efficient Stack”): A Series LLC is a single legal entity that creates distinct, statutorily protected “Series” or “Cells” within it. Each Series acts as a separate legal compartment, with the assets and liabilities of one Series being segregated from the others. The DSCR loan is originated to the Series LLC, and the specific property is titled to a specific Series. This structure offers the same liability isolation as the Parent-Subsidiary model but with lower annual state registration fees and a single tax filing (depending on the state).

The Critical DSCR Lending Constraint: The Personal Guarantee

While DSCR loans are non-recourse to your personal income, nearly all are full-recourse to the borrowing entity and require a Personal Guarantee (PG) from the primary owner. The entity structure does not eliminate the PG; rather, it limits the scope of the liability to a breach of contract (e.g., fraudulent misrepresentation, willful destruction of property, or failure to maintain insurance), and most importantly, it still maintains the liability shield between properties for general operational risk (e.g., tenant slip-and-fall lawsuit). Work with your lender to ensure your chosen entity structure is fully compliant with their underwriting standards.

STAGE 2: Accelerated Wealth Compounding with the 1031 Exchange

The true power of DSCR financing is unlocked when it is seamlessly integrated with the Section 1031 Exchange. The ability to use property cash flow for qualification allows you to move rapidly to secure a replacement property without the delays of compiling personal tax returns or facing conventional debt-to-income (DTI) scrutiny.

Strategic DSCR Financing in the 45-Day Identification Window

The 45-day identification period is the single greatest pressure point in a 1031 exchange. A DSCR loan offers a tactical advantage here:

- Speed and Certainty of Qualification: Since the lender underwrites the new property’s projected rental income (often via an appraisal-driven market rent analysis) rather than the investor’s tax returns, the loan approval process is significantly streamlined. This speed is non-negotiable when a delayed closing can void the entire exchange.

- Replacing the Debt (Avoiding “Boot”): To defer all capital gains tax, the investor must acquire a replacement property of equal or greater value and replace the relinquished property’s debt with an equal or greater amount of debt. A DSCR loan is perfectly suited to this, as the LTV and DSCR requirements can be adjusted to ensure the new loan amount fully replaces the previous debt, thus avoiding taxable “mortgage boot.”

STAGE 3: The Passive Exit Strategy with a Delaware Statutory Trust (DST)

The final, most advanced component of the Mega-Stack is the transition from active, entity-managed properties to a fully passive, tax-deferred vehicle: the Delaware Statutory Trust (DST). This strategy solves the problem of “landlord fatigue” while preserving all accumulated tax deferrals.

The DST as the Ultimate 1031 Replacement Property

A DST is a legal entity that allows investors to own a fractional interest in a large, institutional-grade commercial property (e.g., Class A multifamily, medical office, or industrial space). For tax purposes, the IRS treats the DST interest as direct property ownership, making it a qualifying “like-kind” replacement for a 1031 exchange.

- 100% Passive Ownership: The sponsor of the DST handles all management, maintenance, and leasing. The investor receives monthly distributions and K-1s. This is the ideal solution for the investor who wants to exit active management without triggering a massive capital gains tax bill.

- Non-Recourse Debt: A crucial advantage is that DST financing is typically non-recourse to the investor, satisfying the need to replace debt while eliminating the personal guarantee. This is a powerful risk-mitigation step as the investor approaches retirement or focuses on different asset classes.

- Estate Planning: The deferred capital gains are passed on to heirs who, under current tax law, receive a step-up in basis, effectively wiping out the tax liability upon their inheritance. This makes the DST a powerful legacy wealth tool.

Portfolio Risk Mitigation Beyond the Entity Structure

While legal structure handles internal litigation risk, successful long-term DSCR portfolio management requires a proactive approach to market and financial risk.

Stress Testing the Portfolio DSCR

Smart investors do not rely solely on the lender’s underwriting DSCR. They stress test their portfolio-wide DSCR against two critical scenarios:

- Vacancy Shock: A $1.05 \ DSC on a single property may not survive a three-month vacancy. Stress test the portfolio assuming a 10% permanent rent reduction or 15% aggregate vacancy rate across the entire portfolio. The goal is to maintain a portfolio-wide DSCR > 1.0 even in this adverse environment.

- Interest Rate Spike: For investors utilizing Adjustable-Rate Mortgages (ARMs), calculate the payment at the fully indexed rate cap. This should be modeled to ensure the property still cash-flows, or that an exit/refinance strategy remains viable.

Maintaining the Corporate Veil

The strongest entity structure is worthless if the corporate veil is pierced. DSCR investors, especially those with multiple LLCs, must adhere to strict operational discipline:

- Segregation of Funds: Never use a personal bank account for property expenses or property bank accounts for personal expenses. Maintain distinct bank accounts for each entity.

- Formal Documentation: Ensure the Parent LLC’s Operating Agreement explicitly authorizes the Subsidiary LLC/Series LLC to secure non-conventional financing and execute personal guarantees. The failure to maintain a formal operating agreement or meeting minutes is a common reason for veil-piercing.

3. Verification Summary (3 Key Facts + Sources)

| Key Fact/Figure | Summary | External Google Search Source |

| DST Tax Treatment | For federal income tax purposes, the IRS treats an interest in a Delaware Statutory Trust (DST) as direct property ownership, allowing it to qualify as a “like-kind” replacement property under Section 1031 of the Internal Revenue Code. | Source: Search for “Delaware Statutory Trust 1031 like-kind property IRS treatment” |

| 1031 Debt Replacement Rule | To fully defer capital gains tax in a 1031 exchange, the replacement property’s value must be equal to or greater than the relinquished property’s value, and the investor must replace the amount of debt on the relinquished property, or make up the difference with new capital, to avoid “mortgage boot.” | Source: Search for “1031 exchange replace debt boot rule” |

| Series LLC Liability Shield | A Series LLC is a single legal entity that can create distinct, statutorily protected “Series” or “Cells,” where the debts, liabilities, and obligations incurred by one Series are solely enforceable against the assets of that Series, providing intra-entity asset protection. | Source: Search for “Series LLC internal liability shield and DSCR lending” |