- Target Audience: Fix-and-flippers and rehabbers.

- Key Concept: The “Refinance” exit strategy is finally viable again.

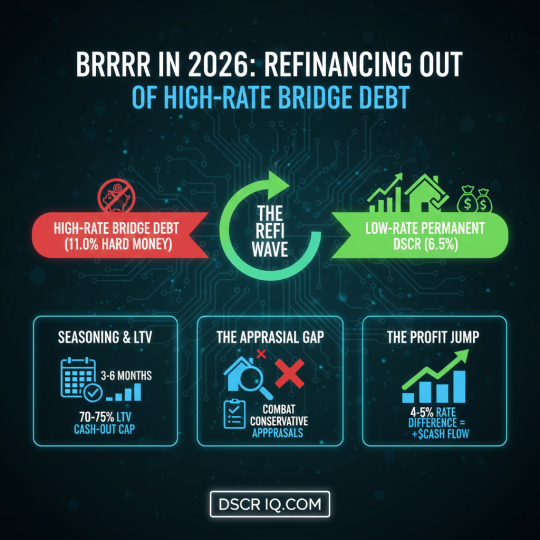

The investment strategy known as BRRRR (Buy, Rehab, Rent, Refinance, Repeat) faced major headwinds between 2023 and 2025. The high cost of the ‘R’ (Refinance) made the entire model questionable, often forcing investors to sell rather than hold.

However, 2025 marks the return of the viable BRRRR model. With fixed rates stabilizing, the refinance exit strategy is not just possible—it’s now the most profitable way to exit a short-term, high-interest construction loan.

The Bridge-to-DSCR Pipeline

The most common refinance challenge in the BRRRR model is the transition from expensive bridge debt or hard money to a permanent, low-rate mortgage.

In 2024 and early 2025, hard money loans often sat in the 10% to 12% range. Refinancing that into a permanent loan at 8.5% offered too little relief. In 2026, the pipeline is far more attractive:

- Entry Debt: High-rate Hard Money/Bridge Loans at 10.0% – 11.5%. (Necessary for the speed and flexibility of the Rehab phase).

- Exit Debt (Permanent): Long-term DSCR Loans settling into the 6.0% – 6.5% range.

This gap of 4 to 5 percentage points creates the significant monthly cash flow buffer needed to make the ‘R’ (Rent) and the second ‘R’ (Refinance) profitable. The DSCR product remains the ideal exit because it underwrites the property’s income (post-rehab) rather than the investor’s personal income or tax returns, streamlining the exit process.

Seasoning: The Refinance Waiting Game

After all the hard work of buying and rehabbing is done, the biggest regulatory hurdle is seasoning—the time required between taking title and executing a cash-out refinance at the property’s new, higher appraised value.

- The 3-6 Month Standard: Most DSCR lenders require a minimum of 3 to 6 months of seasoning from the date the investor closed on the property. This waiting period is required to prove market stability and allow the public record to update. If you use a bridge loan, you must factor this 3-6 month holding period into your profit projections.

- The Rare “Day 1” Exception: True “Day 1” cash-out refinances, which use the new appraised value immediately after rehab completion, are extremely rare in 2025. They usually require a history of highly experienced borrower status, excellent DSCR metrics on the subject property, and significantly lower LTV ratios (e.g., 60% max). Do not bank on this exception unless you have already confirmed it with your broker.

Cash-Out Caps: Maximizing Your Equity Extraction

When you refinance a BRRRR property, your goal is a cash-out refinance: pulling out all the capital you initially put in (down payment, rehab costs, closing fees) and leaving none of your own money in the deal.

In 2026, lenders remain cautious about aggressive equity extraction, capping the maximum loan amount based on the new appraised value:

- 2025 Cash-Out LTV Limit: Cash-out refinances are generally capped at 70% to 75% LTV (Loan-to-Value) of the new, post-rehab appraised value.

- The Importance of Cost: You must ensure that your total initial cost (Purchase Price + Rehab Costs) divided by the final Appraised Value does not exceed this 70-75% cap. If your total cost is $300,000, and the new value is $400,000, the 75% LTV limit means the maximum loan you can get is $300,000. Any cost over that LTV limit remains trapped equity until you pay down the loan.

The “Appraisal Gap”: Dealing with Conservative Values

The final, and most common, hurdle in the 2025 BRRRR cycle is the Appraisal Gap.

Due to volatility in the housing market, appraisers are applying much more conservative metrics than in previous years. They are focused primarily on recently sold comparable sales (Comps) that closed after the rate hikes, rather than accepting the projected value of the rehab work.

- The Lender’s View: The lender sees a post-rehab appraisal that is lower than the investor expected. This immediately lowers the maximum Cash-Out LTV you can achieve, reducing the amount of cash you can pull out.

- Strategy to Close the Gap:

- Supply Data: Provide the appraiser with a detailed, professional-grade list of all improvements, including before-and-after photos, and evidence of premium materials used.

- Highlight Comps: Supply your own list of the best, most recent comparable sales in the neighborhood to guide the appraiser toward a higher valuation.

- Order Second Appraisal: If the first appraisal is drastically low, a new DSCR lender may allow you to purchase the loan using a second, independent appraisal, which can sometimes close the gap and save the deal.