For investors who have moved past the initial phases of acquisition and now own five or more rental units, managing multiple individual mortgages becomes a significant administrative burden. With interest rates stabilizing in 2025, the Portfolio Loan is strategically positioned as the essential tool for mature investors to streamline their operations, reduce compliance overhead, and efficiently unlock capital.

One Payment, One Rate: The Power of Simplification

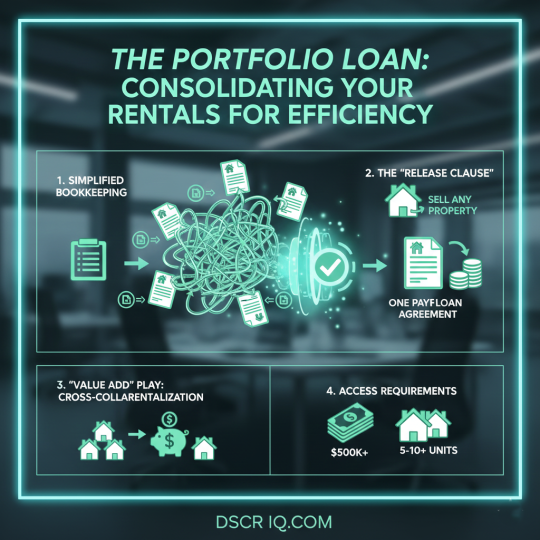

The core advantage of a portfolio loan is the massive simplification of debt management. Instead of tracking 5, 10, or even 20 separate mortgage payments, interest rates, escrow accounts, and maturity dates, a portfolio loan bundles all the properties under a single legal agreement.

- Bookkeeping Clarity: This drastically simplifies bookkeeping, reconciliation, and tax preparation.

- Master Loan Administration: You receive one monthly statement and make one single payment, eliminating the administrative risk of missing a payment or mismanaging funds across numerous accounts.

- Rate Averaging: You secure a single, fixed interest rate across the entire portfolio, often allowing you to average down the rate on older, higher-interest loans while slightly increasing the rate on low-rate loans, resulting in a net benefit or a worthwhile trade-off for simplicity.

The Release Clause: The Crucial 2025 Requirement

Older portfolio loans were highly restrictive, making it impossible to sell a single property without incurring massive penalties or forcing the sale of the entire portfolio. In 2025, sophisticated lenders offer a non-negotiable feature for serious investors: the Release Clause.

- Definition: A Release Clause (also known as a Partial Release) is a contract provision specifying the exact formula required to pay off the portion of the loan attributed to a single property.

- Functionality: This allows you to sell, execute a 1031 exchange, or simply pay off one property in the portfolio without triggering any penalty or re-underwriting requirement on the remaining assets.

- Negotiation Tip: Ensure the release requirement is reasonable, usually defined as 110% to 125% of the property’s original loan balance. For instance, if a property’s portion of the loan was $100,000, the release clause might require a $115,000 payment to detach it from the master loan.

The “Value Add” Play: Cross-Collateralization

A powerful benefit of the portfolio loan is its ability to facilitate the “Value Add” strategy—using equity from stabilized properties to fund new acquisitions.

- Unlocking Equity: By cross-collateralizing five properties, you pool their total equity. Lenders can then issue a cash-out refinance against the entire portfolio’s combined value.

- Strategic Reinvestment: This cash-out can be used to fund the down payment, rehab costs, and reserves for your 6th, 7th, or 8th property.

- Key Advantage: Since the underwriting is based on the strong, combined cash flow of the existing portfolio, the process is faster and often avoids the strict LTV/DSCR requirements applied to a standalone, new acquisition.

Minimums: Accessing the Product

Portfolio loans are specialized commercial products designed for large-scale operations. As such, they come with high entry barriers:

- Minimum Loan Amount: Most lenders require a minimum total loan amount, typically $500,000 to $750,000, to justify the underwriting and legal complexity.

- Minimum Unit Count: Expect lenders to require a minimum of 5 to 10 units to qualify for the program. If you are below this threshold, individual DSCR loans are usually the most efficient path.