- Target Audience: All borrowers (Beginner to Expert).

- Key Concept: A tactical guide to getting approved in <21 days.

The promise of the DSCR loan is speed—the ability to close on an investment property in three weeks or less, bypassing the bureaucratic drag of conventional mortgages. However, that speed relies entirely on your preparation.

In 2025, the market has standardized the underwriting process, meaning success or failure hinges on a single factor: the completeness and accuracy of your document stack.

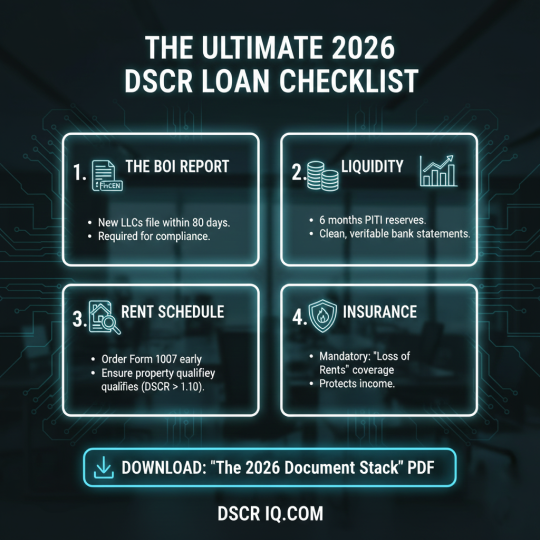

This checklist is your tactical guide to ensuring a smooth approval in under 21 days, covering the standard financial requirements and the crucial new regulatory steps that can derail your closing.

Step 1: The BOI Report—The New Compliance Gate

The most significant regulatory change in 2025 for real estate investors using LLCs is the requirement to file a Beneficial Ownership Information (BOI) Report with the Financial Crimes Enforcement Network (FinCEN). This is non-negotiable.

- The Mandate: If your Limited Liability Company (LLC) was created on or after January 1, 2024, you must file your BOI Report with FinCEN within 30 calendar days of its creation. Existing companies generally have until 2025, but lenders are already asking for proof of compliance.

- Lender Impact: DSCR lenders are now using this report as a mandatory step in verifying the legal standing of the LLC. If your LLC is new and you haven’t filed, your loan will not move forward.

- Action Item: File your report immediately and keep the FinCEN confirmation receipt ready.

Step 2: Liquidity—The 6-Month Reserve Standard

While DSCR loans don’t look at your personal income, they aggressively vet your liquidity and reserves. The standard requirement in 2025 has settled on 6 months of Principal, Interest, Taxes, and Insurance (PITI) for the subject property, held in liquid accounts.

- Clean Reserves: Your reserve accounts (checking, savings, money market) must show clean, verifiable activity. Underwriters are highly sensitive to “mattress money” transactions—large, sudden cash deposits that cannot be sourced (e.g., a $50,000 cash deposit made two weeks before closing).

- Verifiable Source: All funds used for the down payment and reserves must be traceable back to their origin. Use bank statements that cover the past 60 days to show consistent account activity.

- Action Item: Consolidate your reserves into one or two clean accounts well in advance of applying for the loan.

Step 3: Rent Schedule—The Immediate Income Proof

The Debt Service Coverage Ratio (DSCR) is the heart of this loan, and it is calculated using the property’s market rent. To prove this rent, the lender requires an independent appraisal addendum, often called the Form 1007 (Single Family Comparable Rent Schedule).

- DSCR Calculation: The lender takes the rent provided on the 1007 (usually determined by the appraiser based on comparable rental properties) and divides it by the PITI payment. The resulting ratio must meet the lender’s minimum (typically 1.10 or higher).

- Order Early: Do not wait for the loan processing stage. If the property’s DSCR is the weakest link, pre-ordering a BPO (Broker Price Opinion) or Rent Schedule can confirm the property will qualify before you pay for a full appraisal.

- Action Item: Discuss the rental comps and the required DSCR minimum with your broker before submitting the application package.

Step 4: Insurance—The Loss of Rents Mandate

Lenders treat the rental income as the primary protection for the loan. If a fire or major event occurs, the property will stop generating income, putting the loan at risk. To mitigate this, Loss of Rents coverage (also known as Fair Rental Value coverage) is now mandatory on virtually all DSCR policies.

- Coverage Details: This insurance pays the investor a pre-determined amount of lost rent for a set period (typically 12 months) while the property is being repaired.

- Closing Requirement: The lender will scrutinize the final binder and require explicit confirmation that this coverage is in place before authorizing the closing.

- Action Item: When getting quotes, specifically ask your insurance agent to confirm that “Loss of Rents” coverage is included in your policy.

Downloadable: The 2026 Document Stack

For a complete, printable list of all required documentation, click here to download our exclusive “The 2026 Document Stack” PDF. This comprehensive checklist ensures you never miss a step in securing your DSCR financing.