As interest rates stabilize and are projected to trend downward into 2027, the choice of a prepayment penalty structure has become one of the most critical decisions for investors, particularly those planning to sell or refinance their property within three years. Locking into a long, aggressive penalty structure for a minor rate discount can destroy your future flexibility and wipe out years of cash flow.

The Penalty Structures: “Hard” vs. “Soft”

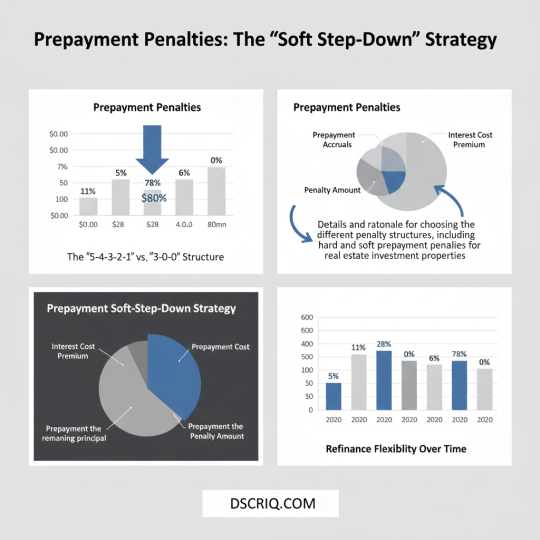

Prepayment penalties (PPP) are standard features on many specialized investment property loans (like DSCR and Portfolio loans). They compensate the lender for the expected interest income lost if you pay off the loan early. Understanding the types is crucial:

| Penalty Type | Structure Example | Description |

|---|---|---|

| Step-Down (Standard) | 5-4-3-2-1 | Penalty applies in Year 1 (5%), Year 2 (4%), and so on, decreasing each year. Often runs 5 years. |

| Soft Step-Down | 3-2-1 | Penalty is 3% in Year 1, 2% in Year 2, and 1% in Year 3. 0% thereafter. |

| Yield Maintenance | N/A (Hard) | Highly restrictive. Requires you to pay the lender the difference between the loan rate and current Treasury yields, often costing 10% or more. AVOID. |

| Fixed/Declining | 3-0-0 | 3% penalty if paid in Year 1, 0% thereafter. Offers maximum flexibility after the first year. |

The 2026 Strategy: Prioritize Flexibility

With market expectations pointing toward potentially lower rates in the next 18-24 months, the strategic goal is to align your penalty expiration with the expected refinance window.

- Avoid Hard Penalties: Steer clear of any penalty structure lasting longer than four years (e.g., 5-4-3-2-1) or any restrictive structures like Yield Maintenance. Locking into a 5-year penalty means you cannot take advantage of the lower rates expected in 2028/2029 without incurring a massive fee.

- Opt for Soft Step-Downs: The 3-2-1 penalty structure is the optimal choice for 2026. This allows you to avoid the highest penalty after year one and be completely free to refinance or sell by Year 4 (2029).

Buying Flexibility: The Cost of Peace of Mind

Lenders price their loans based on the predictability of their long-term return. A shorter or softer penalty structure reduces that predictability, so they charge a small premium on the interest rate.

- The Rate Gap: Expect to pay an additional 0.25% to 0.50% on your interest rate to switch from a rigid 5-year penalty to a flexible 3-2-1 penalty.

- The Math: The cost of the penalty is usually worth the upfront rate premium. Consider a $500,000 loan:

- Scenario A (5-Year Hard Penalty): You sell in Year 3 when rates have dropped 1.5%. You owe a 3% penalty, costing you $15,000.

- Scenario B (3-Year Soft Penalty): You pay an upfront premium of 0.50% (costing about $200/month). You sell in Year 3 and owe a 1% penalty, costing you $5,000.

The short-term cost is easily offset by the $10,000 saved on the penalty, plus the flexibility to refinance into a lower rate without penalty after Year 3. Paying a little more interest now buys you the freedom to capitalize on cheaper money later.