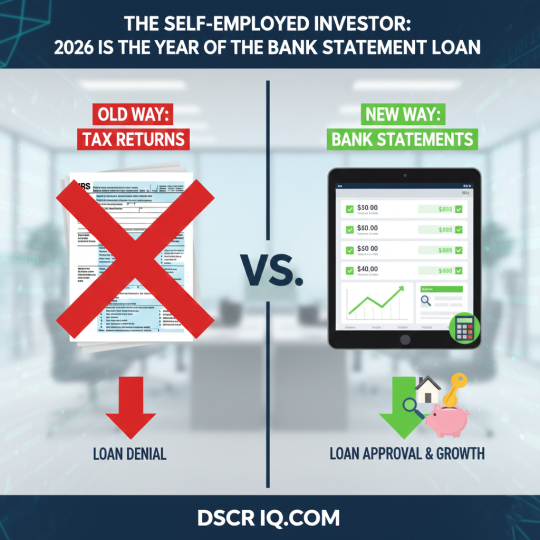

The self-employed investor constantly faces the “Write-Off” Paradox. The smarter you are at legally minimizing your taxable income, the harder it is to qualify for a conventional mortgage.

Traditional bank underwriters rely solely on two years of tax returns. Inevitably, aggressive business deductions drive net income too low. This prevents qualification for a large mortgage loan. This creates a significant barrier for successful entrepreneurs seeking conventional financing.

Now, however, specialized lenders have created mainstream solutions in 2025. These eliminate the need to choose between tax efficiency and loan eligibility.

Bank Statement Loans 2.0: Quantifying True Cash Flow

The modern “Bank Statement Loan” moves the focus from taxable income to true cash flow. Lenders recognize that tax returns do not reflect the actual viability of a business owner’s income stream.

- 12-Month vs. 3-Month Review: The new standard is a review of your business bank statements over a specific period.

- 12-Month Review (Standard): Lenders aggregate your full year of deposits. They then apply a standard 50% expense ratio to determine monthly qualified income.

- 3-Month Review (Expedited): For borrowers with exceptional reserves or rapidly accelerating income, some programs now offer a 3-month review, focusing on the average of recent deposits to capture current momentum.

- The Deposit Math: Crucially, the bank statement method shifts the focus. It uses gross deposits into the business account, bypassing tax returns. After applying the 50% expense factor, the resulting income often far exceeds the net income shown on a Schedule C or K-1, easily qualifying the borrower for the necessary debt.

P&L Only: The CPA-Signed Pathway

Some business owners prefer privacy. They avoid 12 months of bank records. A specialized sub-program accepts one comprehensive income document.:

- The CPA-Signed P&L: A Profit & Loss (P&L) statement prepared and certified by a Certified Public Accountant (CPA) can often be used as the sole income documentation. This is preferred by larger business owners whose expenses are volatile or who have complex balance sheets. The lender trusts the CPA’s verification of revenue and expense figures over a general tax return.

The Rate Gap: Shrunk to Under 1%

The cost of Bank Statement or DSCR loans was once punitive. They exceeded conventional pricing by 2% to 3%. Consequently, this cost disparity mandated they function as a last resort.

In 2026, the market has standardized and normalized the risk models for these products.

The Value Proposition: For a self-employed investor, the ability to close on a property quickly, without fighting underwriters over depreciation and write-offs, is well worth the minor rate premium. The efficiency and reliability of the Bank Statement path make it the default strategy for business owners seeking investment properties.

The New Reality: Today, the Bank Statement Loan rate often closely mirrors the conventional owner-occupied rate. The gap narrows to 0.50% to 0.75%.